Dave Mello

Horizon Retirement Advisors, LLC

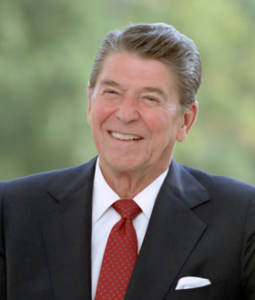

Trust: Use the Ronald Reagan Approach

Trust but verify

The other night I saw a feature on the news about the lawsuit between a car purchaser and the car manufacturer. The car company had placed the disclosure of what could be expected mileage-wise on the window. The statement was simple; 49 miles per gallon average on the highway and 43 mpg for city driving.

The lawsuit was based on an argument that the car purchaser only received a lesser result.

How about dealing with financial professionals? Many sales pitches begin verbally, and as the broker or agent explains the benefits of their product, it can begin to sound way too good.

Here are a few tips to protect you:

- Get all sales pitches in writing. Make sure the company providing the security has enclosed all disclosures, including the prospectus. Read and ask questions about the prospectus.

- Ask about any ongoing fees and expenses. If the offering is a mutual fund, ask about loads, expense ratio, 12 b-1 fees, and the class of the mutual fund. A, B. C class all can have different fee structures.

- Ask for help from a 3rd party if you do not entirely understand the prospectus.

- If the offering is an insurance product, ask for a product brochure and the phone number of the insurance company's customer service system. Call the home office if you do not completely understand the product.

- Never make a decision immediately; take your time, and get a second opinion. Make sure the offering will help you achieve your goals.

And use the Ronald Reagan approach: Trust but verify.

Trustworthiness is earned and should never be automatically granted.

Dave Mello

Horizon Retirement Advisors, LLC

707 Mount Rose St.

Reno, Nevada 98509

horizon@retirevillage.com

(775) 851-4754

Looking For Answers?

Download our Safe Money Guide and learn more about safe retirement options that can help you achieve your retirement goals safely - FREE!